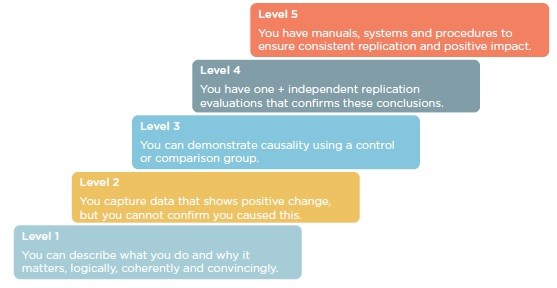

Two and a half years ago, we launched Nesta Impact Investments, a fund that aims to scale innovative solutions to the UK’s most challenging social issues. We want to see our ventures develop financially while also demonstrating the positive social impact of what they do. This means we invest in ventures that have a credible theory of change and work with them to carry out high quality evaluation over the course of our investment, using our Standards of Evidence framework.

The standards of evidence

Last week, we launch a paper that discusses what we’ve learnt from implementing this approach over the last two years. Our ventures are at the point where they are building impact measurement into the day-to-day running of activities, and are balancing impact with commercial success.

So what have we learnt?

- A flexible approach: a start-up environment means that ventures will change and develop as time goes by. This can be a challenge to impact measurement as it needs to be flexible enough to allow for innovation and robust enough to measure meaningful results. To do this, FutureGov, a company exploring how technology can support public services, used theories of change to highlight important outcomes they could measure, even if the product changed over time. They also waited to evaluate products only when they gained traction. This helped to focus resources where it was most needed.

- Investing in internal and external resource: organizations that have a point- person managing impact measurement see a lot more progress than those who don’t. Furthermore, external partnerships with researchers and academics are key to getting evaluation to the next level of rigour. Oomph!, who run innovate exercise classes in care homes, created a ‘head of impact’ role from day one. This has helped the social enterprise embed impact measurement into its day-to-day operations and has also allowed them to forge partnerships with academics to improve the quality of their evaluation work.

- Balancing the social and financial: there can often be pressure to focus on revenue-generating activities that may not wholly align with the company’s social mission. Having a clear theory of change and impact measurement can ensure that the company considers its mission in making decisions about what markets and revenue streams to pursue. For example, one of our investees, Ffrees, provides a current-account service to people who are underbanked or are financially excluded. They have used impact measurement to ensure that the account is benefiting this group and not other higher income, – but higher revenue – customers.

- Try and try again: running an evaluation, learning about what works, and repeating this process before investing in a higher rigour trial can be incredibly valuable. This ensures the focus is on the right things to measure before running a bigger piece of research. Digital Assess, a company that specializes in innovative educational-assessment products, has run one or two small evaluations, and learnt about what works before committing to a larger evaluation.

- Different trajectories of impact and financial growth: in an ideal world, we aim for all our investees to progress financially while also improving their level of evidence. In practice, we have found that a company may see commercial success before focussing on evaluation, and vice versa. As fund managers, this means we focus support on wherever a company is falling behind – so that in the long run, we see a balance in commercial success and impact success.

From this experience, we’ve summarised key questions we think ventures should think about if they are seeking impact investing:

- What social problem does your venture address?

- Where is the innovation?

- Have you mapped out your theory of change and any evidence that backs up your approach

- Do you have a strategy for scale and sustainability?

- Have you thought about impact metrics and the type of evaluation you will need to do?

The impact investing market has seen tremendous growth over the last few years. If we are to live up to expectations, we need to start measuring and openly discussing our impact. We hope our paper will add to the discussion on how to develop best practice in the field and offer a starting point and guide for ventures and other funds.

Eibhlín Ní Ógáin, insights managerat Nesta Impact Investments.

The post Impact investing – what we’ve learnt appeared first on Alliance magazine.

This post was originally published on AllianceMagazine.org

Visit the Invest With Values - Resource Directory to access leading investor information, opportunities, organizations, events, groups and tools.

Visit the Invest With Values - Resource Directory to access leading investor information, opportunities, organizations, events, groups and tools.